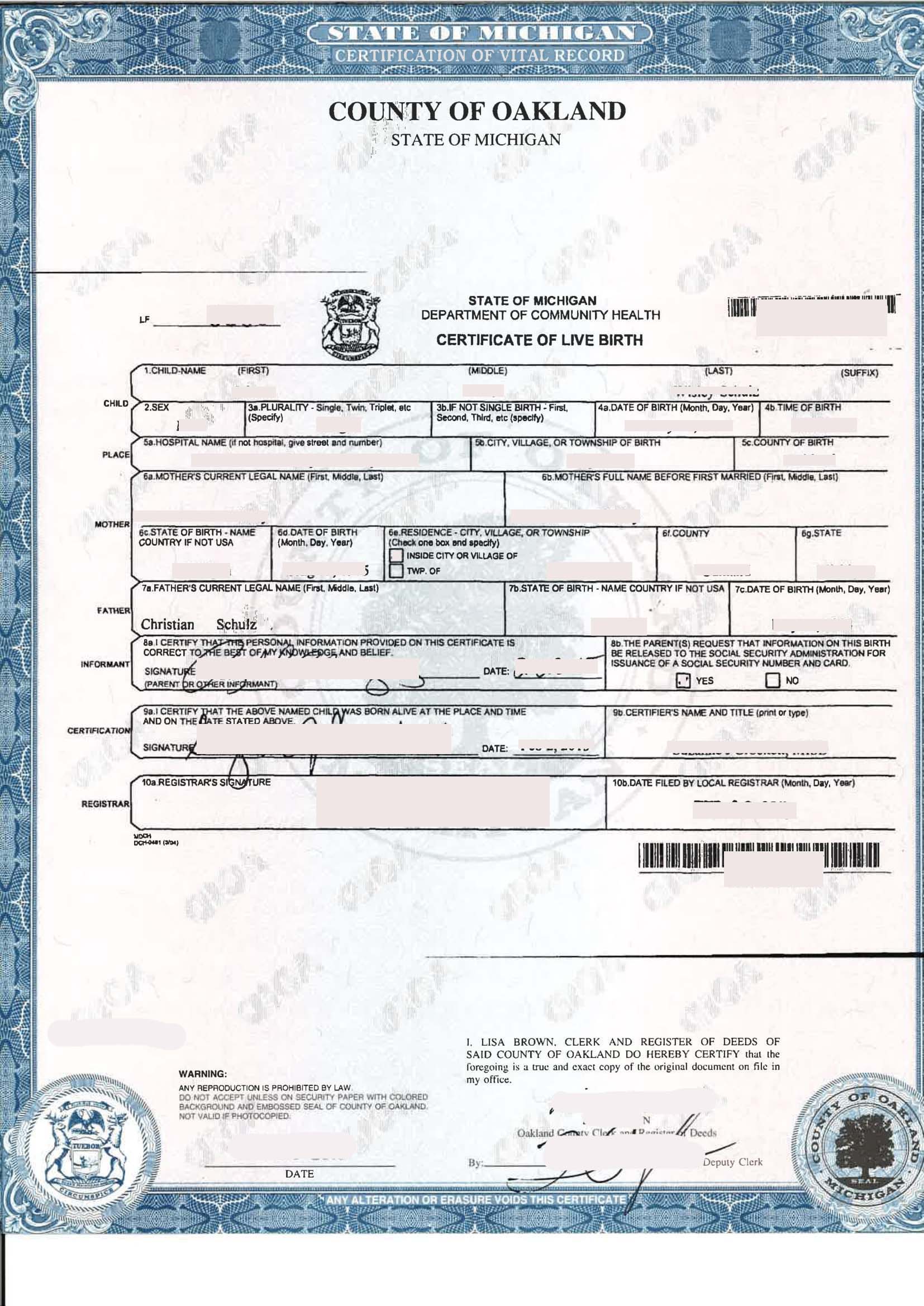

EST and will be available for pick-up after notarization is complete. Please allow 1-2 business days for documents to be processed.Īll documents may be dropped off at 114 Shields Building Monday - Friday 8:00 a.m. A notary will witness and verify the signature on the letter. When you present your diploma or have the Registrar's Office issue you an official transcript or enrollment verification, the University Registrar's office will produce and sign a letter attesting to the authenticity of your document. Note: Requesting Notary Services may delay processing of your request, including overnight delivery, since it will require additional processing time. return all notarized documents to you for any additional processing.only notarize documents produced by the Office of the University Registrar.notarize up to three copies of the same document.Transcripts and diplomas remaining in the United States generally do not need notarization. The official paper transcript is printed on security sensitive paper and contains the University seal and signature of the University Registrar. Notarization of the document is required before the Apostille or Certification by the Commonwealth will be completed. Some foreign countries require that the certified documents produced by the Office of the University Registrar include the Secretary of the Commonwealth's Apostille or Certification. Please contact the Office of the University Registrar at 81 or if you need to schedule an appointment for Notary Services. Make checks payable to “City of Philadelphia.Notary Services are available by appointment only. We do not accept personal checks, credit, or debit cards. You can pay by cash, money order, business, or certified check. If you overpay, we will notify you and send you a form to get a refund of the amount you overpaid. To have a copy certified, there is an additional $2 certification fee per document. To find out the exact number of pages in advance of sending your request, contact us at (215) 686-2292 or are $2 per page. If you mail your request, include a self-addressed stamped envelope and a note with the address of the property. Hours of operation: Monday through Friday, 8:30 a.m. Visit the Department of Records in person, or mail your request and payment to: Online subscription fees vary by length of time. You can get documents recorded before 1974 by mail or in person. Print documents or indexed information with a paid subscription.View document information and watermarked copies online.Search deeds and other property records from 1974 to the present.Philadox is an online document search system. They must go to the Office of Veterans Affairs.Īnyone can request a discharge record if it pertains to something that happened 75 or more years ago. Relatives of veterans cannot get military discharge records from the department. The person who is the subject of the record must present valid identification. When required by the county director of veterans affairs, or a state or federal entity.When required by the process of a court.To the person who is the subject of the record, or their agent or authorized representative.Military discharges are confidential by law. Property records from before 1973 may have to be pulled from the City Archives or require special handling. Deed date (the date listed at the beginning of the deed).Grantee (the person buying the property).Grantor (the person selling the property).If you are requesting a copy of a property record, provide as much of the following information as possible. Register a burglar alarm / Pay the annual fee.Report a problem with a building, lot, or street.Apply for a low-interest home improvement loan.Get home repairs and modifications for seniors.

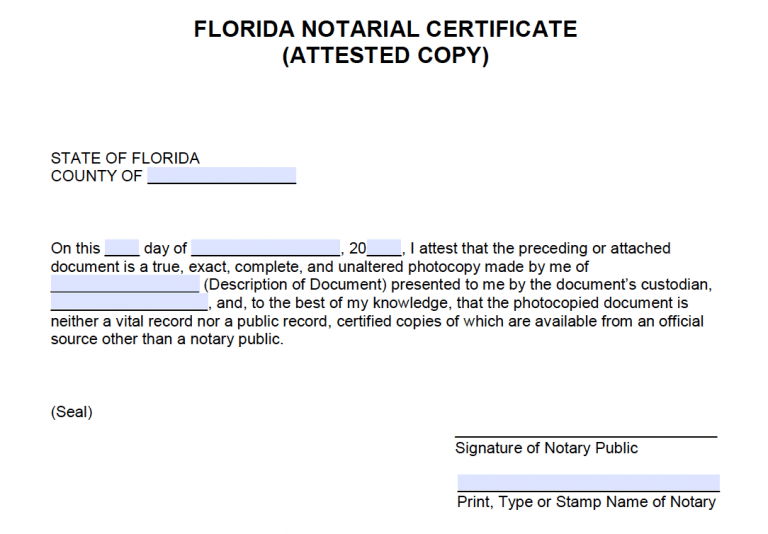

UPS NOTARIZED PHOTOCOPY LICENSE

Get a Vacant Commercial Property License.Get a Vacant Residential Property License.Visit a City-funded homeless intake center.Get help if you are facing homelessness.Report suspected deed or mortgage fraud.Nominate a historic property or district.Apply for a grant to clear your home’s title.Save your home from mortgage and tax foreclosure.Find a licensed contractor and contractor information.Get a real estate tax adjustment after a catastrophic loss.Get a nonprofit real estate tax exemption.Set up an Owner-occupied Real Estate Tax payment agreement (OOPA).Low-income senior citizen Real Estate Tax freeze.

Set up a Real Estate Tax installment plan.Enroll in the Real Estate Tax deferral program.Report a change to lot lines for your property taxes.Get a copy of a deed or other recorded document.

0 kommentar(er)

0 kommentar(er)